- We are now in the post-capitalist era. Markets no longer exist.

- There has been an economic coup.

- The virus was used to create a policy response that popped the Everything Bubble and facilitated cover to place the bankrupt and insolvent economy in receivership.

- The Central Bank cartel is the receiver.

- A managed reorganization is in progress that will allow the economy to re-emerge from receivership but it will not be the same economy.

(The following is the introduction to the latest BullBear Market Report, "The Dawning Of A New Era: Post-Capitalism 1.0")

There is only one holistic system of systems, one vast and immane, interwoven, interacting, multivariate, multinational dominion of dollars.

It is the international system of currency which determines the totality of life on this planet. That is the natural order of things today. That is the atomic and subatomic and galactic structure of things today!

Our children will live, Mr. Beale, to see that perfect world in which there's no war or famine, oppression or brutality -- one vast and ecumenical holding company, for whom all men will work to serve a common profit, in which all men will hold a share of stock, all necessities provided, all anxieties tranquilized, all boredom amused.

--Arthur Jensen (Ned Beatty) to Howard Beale (Peter Finch), Network, 1976, Network - Money speech

Readers of the BullBear Market Report have been following as I have tracked the progress of what I conceptualized as the final 5th wave of a Secular Long Wave in markets, economics, politics and society that began, as measured and indicated by the Dow Jones Industrial Average (DJI), in 1949. Accompanying the completion of this very long term secular movement in the general advancement of human structures, we have anticipated a disrupted period of transition, similar or at least analogous to the 1929-1949 period. In my last report, "Apocalypse Now? The Secular Shift at the Crest of the Long Wave", I concluded that there was sufficient cause to think that the 70-year cycle had completed and that we are now participating in the "Secular Shift" to a new paradigm.

While we can look to the past for clues as to what to expect from this contemporary experience, we also need to keep in mind that history does not repeat itself, it merely often rhymes. In this introduction to the latest BBMR, we're going to take a detached view of the current reality so that we can establish a fresh, unbiased and free context for our trading and investing decisions.

Long ago, in 2013, in "The Death of Disasterism", I surveyed the various prevailing market viewpoints and concluded that from a contrarian perspective, the bullish outlook was the most viable. I held this view while at the same time anticipating that the assumptions that underpinned it would ultimately come to an end. And it seems there is every reason to think that that end has arrived. At this pivotal time, it's also appropriate to do a "self-check" to make sure that we are not proceeding from ingrained bias and lazy assumptions.

Generally, I avoid commentary and stay focused on technical analysis. But at certain junctures, context becomes primary to any analytical framework. And this is definitely one of those times.

Today we are confronted with an unprecedented global cessation of economic activity, trade, consumption and travel. Simultaneously, we are presented with an equally unprecedented monetary and fiscal intervention by central banks and governments. This situation was provoked not by a viral pandemic, but by the global governmental response to the potential for a viral pandemic. Regardless of what you may think about the origins of the COVID-19 virus, the response to it and the consequences of that response is entirely man-made.

Shutting down the US economy entirely and placing the population in "lockdown" mode was a choice, not a necessity. The threat of the virus could also have been managed by:

- Vigorous public education on proper use of Personal Protective Equipment

- Kinds of face masks, how and when to use them

- gloves

- sanitizers

- recommendation for workplace and public space PPE use and sanitary practices

- Government direct purchase and distribution of masks and PPE to the public and health care facilities via states and city government agencies

- Government authority compelling appropriate industries to manufacture appropriate PPE; contracting to purchase the resulting production

- Restriction of travel to and from global viral hotspot centers

- Recommending that large scale gatherings be postponed

- Advising that at-risk populations (elderly) be isolated

- Vigorous public education on proper diet, nutritional and exercise guidelines to boost immune system efficiency

If government had speedily and efficiently exercised such responsible and forthright leadership, in place of launching an irrational panic, we could have controlled the outbreak of the virus, preserved our economic and personal well-being, retained our freedoms and placed ourselves in a good position from which to recover from the relatively mild disruption.

Instead, panic was chosen. The resulting economic crisis is completely man-made.

It is man-made because prior to the first coronavirus case, the entire U.S. and global economy was floating on the thin skin of an Everything Bubble, inflated continuously since the institution of ongoing Quantitative Easing and near-zero interest rates in the wake of the last man-made financial crisis. And it is man-made because the policy response of panicked shutdown lockdown was totally unnecessary. And I will go so far as to state that at the highest levels of power, the coronavirus was seized upon as an opportunity to use the potential for a pandemic as the pin to intentionally prick the Everything Bubble with the right hand while waiting with the left hand to bail the whole mess out using the virus as a cover to accomplish strategic goals that could not be accomplished absent an atmosphere of total crisis and panic.

At a Secular Shift, it's reasonable and appropriate to anticipate and expect fundamental changes to financial, economic, political and social structures. Generally, one might hope for an eventually better future, following a difficult period of transition and gestation. I think we can say that we are in the midst of such a period now, but its characteristics and the eventual outcome may not be unfolding as many have expected.

We have to first wrap our minds around the basic facts of recent events. The most essential fact is that the U.S. and global economy is now in receivership. It has been declared insolvent and shut down. The receiver is the Central Banking Authority. The maintenance and operation of all economic (and by extension, political and social) mechanisms is now in the possession of the fundamental power to create money. By fiat power, the entirety of economic activity has been extra-legally declared to be under the direct and ultimate purview and responsibility of the Money Power.

This is nothing short of a coup. The seizure of ultimate power by extra-legal means under the mantle of presumed and unchallenged authority and the cover of fear.

The Federal Reserve Bank, as the issuer of the global reserve currency, and its associated global central banks, have unilaterally granted themselves the power to issue any amount of currency. They have declared the power to buy and sell with literally unlimited artificially-created funds in any market at any time for any reason. They have issued the edict that all bankruptcy, all default and all consequence for any misallocation of resources is illegal and null. Any form of speculation and financial engineering, whether in the past, present or future, has been sanctioned and authorized. Those without access to the spigots of central bank liquidity will receive subsistence levels of Universal Basic Income.

There are no more free markets. There is no capitalism. If there is an actor in the markets which can intervene in any way at any time for any reason in any amount without any process of authorization then there are no markets. There is only pure, centralized, fiat power.

None of this could have been accomplished absent a pervasive atmosphere of fear and a population willingly submitting to lockdown. There are no tanks in the streets, but the first UBI checks are in the mail.

Since the Everything Bubble would have eventually burst on its own, it was decided to intentionally pop it, place the economy in receivership and then effect a controlled reorganization.

Just as the first experimental rounds of Quantitative Easing and near-zero real interest rates were never rolled back, long after the financial crisis was over and well into a supposed economic recovery, the current state of affairs will never be reversed. Instead, this sudden power grab will form the basis of financial, economic, political and social authority going forward, a foundation upon which a new order will be built.

Since 2008, free market capitalism has been held captive in a cell, tortured, beaten and bloodied. In March 2020, it was taken out back, put up against a wall and shot in the head. We are in Post-Capitalism 1.0 now.

Many had hoped that the Keynesian monetarist debt consumption model would implode, leading to the evolution of a new form of economic, political and social freedom. While this remains possible, what we are faced with in actuality is a controlled, managed transition to a new order.

Inevitable deflationary forces have required a paradigm shift. For years monetary authorities have failed to produce the inflation necessary to the propulsion of the Keynesian system in spite of the loosest financial conditions ever. The advancement of technology is inherently deflationary, continually lowering costs across the economy. And the fundamental demographic conditions in the U.S. and the world are also highly deflationary. Populations of young, child-bearing age are declining while populations of people over 65 are growing. Without general population growth, and specifically population growth of the consuming age group relative to the retiring age group, the continuing growth of debt and consumption is simply not possible. It's also unlikely that a truly free market capitalist model could be successful faced with these deflationary pressures. So it's inevitable that something other than what has already been tried will have to result.

So this Secular Shift involves a managed transition from the vestiges of the free market past to...something else. For the moment we're going to assume that there will not be an actual revolution against this coup, whether relatively soon or at any time in the future, though that remains an extreme outlier possibility. Absent that, there will undoubtedly be elements of a technocratic socialism as the scientific technocracy, financial oligopoly and political class consummate their marriage with the central banking power. Artificial Intelligence is bound to play an increasingly larger and larger role in the management of production and society.

Since we now have only the formalism of markets and not their substance, we will have to adjust our approach to participating in them accordingly. As far as I know, there is no word in the English lexicon to describe this reality. One might be inclined to go with "casino", but in a casino there is real risk and the house always wins. Now that risk has been declared illegal and all bets are on, betting with the house seems to be the only way to participate in the game.

To reiterate, it has been declared illegal, punishable by bailout, for any significant entity to default or go bankrupt. No failure will be allowed. The house has literally unlimited funds and it will not allow anything other than a relatively smooth transition to the new technocratic future. There is no limit in quantity and means and method and there is no expiration date to this fiat power.

So although the factual, underlying economic conditions on the ground are likely to be at deep depression levels, the managed transition and reorganization process will move the economy out of receivership in less than a year. But it won't be the same economy. Vast swaths of economic activity will be utterly dependent on support from the money power. Huge chunks of the labor force will be transitioned to Universal Basic Income. What's left of the main street small business economy will either close and cede to the mega corporations or be on permanent life support. As they keep telling us over and over and over again, things will never be the same again. But the reason for that has nothing to do with a invisible virus and everything to do with an obvious yet largely unacknowledged economic power coup. And periodic viral outbreaks will serve to reinforce and expand the same.

What does all this mean for our participation in the not-market game?

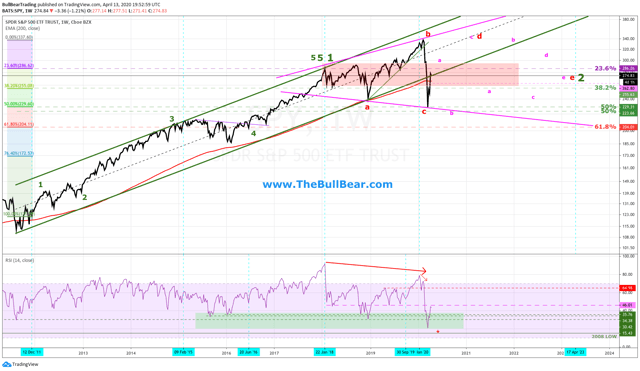

My current view is that since the January 2018 top the S&P 500 has been in a large, wide ranging Elliott Wave triangle bear market and that continued movement within the large band described by the 2018, 2019 and 2020 highs and the 2018 and 2020 lows is to be expected for some time, with an eventual resumption of a bull market once the fundamental features of the new paradigm have been established. It could be quite complex and similar in many ways to the 1965-1982 period with many large cyclical swings. For some time, we are likely to be in a trading environment.

SPY, weekly close chart:

The rest of this report will update the price and technical charts. One of the interesting features of this Shift is that many of the technical indicators which served us very well for many years appear to be broken and are no longer functioning. So we will begin the process identifying appropriate technical means of successfully trading the new not-market environment.

Comment

-

Comment by NickS on April 29, 2020 at 6:42pm

-

Hi Steven- would there be timeframes available for the short, intermediated and long? Is short a few weeks to 6months? Thanks!

-

Comment by Steven Vincent on April 18, 2020 at 3:48pm

-

I do say near the end..."To reiterate, it has been declared illegal, punishable by bailout, for any significant entity to default or go bankrupt."

-

Comment by Steven Vincent on April 18, 2020 at 3:38pm

-

Hi Dean thanks for your comment. It is what it is. I just try to see clearly and call things as they are. The details of course we cover in the members area, and you are already a member.

-

Comment by Dean Herback on April 18, 2020 at 1:50pm

-

A pretty bleak picture but even more disturbing is that I really can't think of a spot where you're wrong.

Perhaps only about no one being allowed to go bankrupt. I'd qualify that to say no one 'significan't would be allowed. All small businesses can definitely go under and the Fed and Banks will not care at all. That's just going to be more people collecting UBI, much easier to handle it that way than try and get back to a functioning economy.

I'm jumping ahead but guessing you don't expect any catastrophic crash in equities anymore, simply because it will be prevented by direct intervention. The question would be what's the line in the sand for them to not let stocks fall below.

© 2024 Created by Steven Vincent.

Powered by

![]()

You need to be a member of BullBear Trading: Stock and Financial Market Technical Analysis to add comments!

Join BullBear Trading: Stock and Financial Market Technical Analysis