THE BULLBEAR MARKET REPORT

THE BULLBEAR MARKET REPORT

July 25, 2009

A false breakdown has reversed sharply to new highs. Has a new Bull Market begun?

SUMMARY

Since the last BBMR on May 25th, the equities markets have made a top, established a new downtrend and then threatened to break down out of a head and shoulders formation. The break was rejected with a violent upside thrust to new highs. Market action and technicals are suggestive of a renewed bull trend. Fundamentally, the economic data has generally improved and earnings have exceeded expectations in most sectors. Commodities markets, particularly the precious metals, have continued higher even as equities have stalled and the action in those markets are supportive of the reflation/inflation trade hypothesis. Technically, equities markets continue to near a resolution which is graphically illustrated by the relationship between the 50 and the 200 EMA, with the 50 day continuing to rise and the 200 day falling to meet it. A crossover is due anytime within the next 5 weeks. The author's expectation continues to be that the fundamentals will continue to show gradual improvement, that concerns about sovereign debt and the global economy will continue to play out as bricks in the classic "Wall of Worry" and the markets will manifest this with a bullish crossover of the 50 and 200 EMA, signaling a new bull market. On the other hand, there are still major, structural forces at work in the markets and the world economy which could effectively neutralize the massive reflationary forces unleashed by fiscal and monetary policy leading to a bearish resolution. The short term picture is overbought and some pullback is likely after the strongest two weeks since the bull run began in March. Traders and investors are invited to consider planning a long entry but advised not to chase the market higher. Patience will be rewarded. My current equties market stance is: short term bearish, intermediate term bullish and long term neutral. My current commodities market stance in all time frames (with particular emphasis on the Precious Metals sector) is BULLISH. My position in all time frames (save the immediate term) on the US Dollar is BEARISH.

FUNDAMENTAL ANALYSIS

The primary economic fundamental in an economy based on a fiat debt monetary system is the flow of liquidity. Regardless of one's philosophical leanings, the fact remains that our capital markets and indeed the entire US economy is not much more than a Ponzi scheme. It relies upon the ability and willingness of the next party to go into debt to support the already existing indebtedness. It's simply a matter of supply and demand. The primary question the trader must ask and answer is: are there more buyers of debt with more available equity who want to risk the Ponzi game or are there more sellers of debt who need financing or need to cash out of the game?

At this juncture massive forces of inflation and deflation are seeking resolution. Heretofore unimaginable monetary inflation and fiscal stimulus may, for a time, reflate asset prices in spite of deep structural issues in the real economy. On the other hand, said structural issues may be so profound as to render such inflation ineffective.

At the time of the last BBMR, British sovereign debt had been threatened with a downgrade and this was followed by the apparent threat of a similar downgrade to US Treasury debt. It is the kind of fundamental development which would accompany the next stage of "The Collapse". It appears that this was a non-event and more of the "Wall of Worry" playing itself out. A similar bought of fear came as the state of California came to the brink of fiscal failure. That crisis appears to have been averted as bills are now on the way to the Governator's desk which will close the $24 billion dollar budget gap.

The Wall of Worry is solidly intact, however. A survey of reports on CNBC or Bloomberg on any given day will still find at least 50% of them to be skeptical of the bull or outright bearish. A quick read of blog headlines this morning finds a great deal of bearishness still persists.

The recent decline below SPX 880 came on expectations for disappointing earnings and economic reports. In fact, the biggest decline came on a much worse than expected jobs report. It's worth noting that employment figures are a lagging indicator. Trading on the basis of the past will not lead to profits. I must say that I do not attach much if any importance to government economic statistics or corporate earnings reports. The fact is that such numbers are massaged to produce the effect desired by the inner clique at any point in time. If you think corporate manipulation of earnings died with Arthur Anderson then you are quite naive. And if you think we can rely upon figures from the government you need a reality check. Jesse Livermore pointed out that the news of the day is not important, it's the market's reaction to the news which matters. He also commented that it was common practice for corporate executives to issue negative earnings reports when the inner clique had sold out and while they re-accumulated a position and to only issue positive earnings when they had fully bought their lines. If that kind of gamesmanship transpired a hundred years ago do you think it is less so now? Unlikely. Earnings reports and government statistics are meaningless; the market reaction to the news is the only information the trader needs to focus upon. And thusfar the market has followed a pattern of reacting in a muted and temporary fashion to bad news and to rally strongly on good news. By way of example, Google sold off sharply on its worse than expected earnings report yet has rallied sharply to new highs.

On a longer term basis, I see two possible trajectories for the US economy and equities markets. One the one hand, a temporary reflation of asset prices resulting from monetary and fiscal debt accumulation leading to phantom economic growth which ends badly in a sovereign debt crisis and the collapse of the US dollar. In such a scenario further reflationary schemes spark hyperinflation, a commodities mega bubble and a collapse in risk assets. I'd put that at about 18-36 months out in time. A more optimistic scenario finds much of the new liquidity actually being invested in new growth industries which spark real economic expansion, generate millions of new high paying jobs and create the wealth necessary to the paying down of the nation's debt burden. Such a scenario would necessarily be led by America's one remaining competitive advantage: technology. it has been more than fifteen years (a century in technological terms) since the personal computing and internet revolutions. The economy is long overdue for a new technological revolution which may be imminent. It is worth noting that the Nasdaq 100 is up over 23% year-to-date whereas the Dow and S&P 500 are barely above breakeven. The technology index also produced a 50/200 bullish moving average cross over a month ago. This vast outperformance may very well be forecasting just the technological revolution I am suggesting. I do not yet know which specific sectors or companies will be the epicenters of such a development, but I would dearly like to know. If you have any intel in this direction, please do bring it to my attention.

Regardless of the outcome of the general economic environment, I believe that volatility is now the new normal in the markets. We have seen 20-50% moves become more common and of shorter duration and this is a pattern which will continue as long as fiat monetary expansion refuses to allow normal economic and debt corrections to occur. In fact, since central banks and governments persist with Keynesian monetary and fiscal management and manipulation (and there is no sign that they will ever change course), inflation will be reflected in wider and more dramatic swings in asset prices than ever before.

I think that to continue to apply the term "Markets" to the systems of price settlement that we now associate with the term is a misnomer and a falsehood. We no longer have equities and asset markets. True markets require a method of price discovery based on supply and demand and a reliable unit of measure. A monetary unit should be both a means of exchange and a store of value. The existing worldwide fiat monetary regime only provides for the former. The fiat monetary unit of measure does not store value since its supply and demand is not a function of supply and demand itself but rather of policy on the part of central bankers and governments. Price discovery then becomes unstable and unreliable. Since value cannot adequately discover price it cannot remain as money for any length of time and it is driven to seek return. A constant and exponential expansion of money supply leads to the requirement that value constantly seeks out speculative gain. Value has no safe haven and is tossed upon an increasingly violent sea. This translates into larger and faster swings in asset prices. Under true market conditions, where the monetary unit is a reliable measure and store of value and there is relatively confident price discovery, value seeks investment in productive economic activities first and in speculative returns second. In short, we are bound by the very nature of the existing regime to see massive and frequent price swings across the board for the foreseeable future. Instability and volatility is the new normal. Financial survival dictates that investors must learn to trade these swings and as they do this will of course accentuate the volatility. Hold times of 6-18 months may become long term investments. I hope to expand upon this critical theme at a later date.

MARKET ANALYSIS

In the last BBMR, I noted that the salient chart feature across the board was the developing relationship between the 50 and 200 day EMA. I noted that this relationship signaled a transitional period which is almost always characterized by a period of trendless volatilty. That period is now behind us and appears to be completed. We have seen some sectors develop solid bull markets where others have reversed breakdowns to new highs. This is, in my opinion, a good time to be preparing to get long the equities markets or adding to existing positions. There should be some pullback or consolidation of recent gains however.

The commodities markets have traded essentially in step with equities. This bolsters the suggestion that liquidity rules the waves and that the inflation/reflation trade hypothesis is valid. In particular, the precious metals sector is showing a very bullish configuration. This is a good time to get long gold, silver and the miners.

A survey of the charts at this time shows that across the board the 50 EMA is rising to meet the 200 EMA with price trading in between the two. Most charts are showing a fresh breakout to new highs following a false breakdown produced in the environment of a low volume pullback, a classically bullish technical formation. This is a setup for a transition. It is more than possible for this setup to fail. But there are strong indications that this setup will produce a bullish resolution. Let's have a look at some charts:

INTERMARKET ANALYSIS

Markets outside of the sphere of equities frequently foreshadow developments in the stock markets. At this time many key intermarket indicators appear to be setting up for or currently telegraphing a bullish resolution. The primary setup is in the US Dollar index and its principle currency pairs.

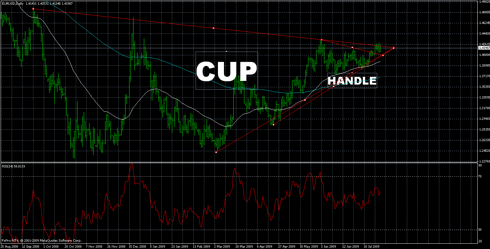

Let's have a look at the EuroDollar first:

After a 12% nearly vertical run to new highs in the SPX every trader and investor is asking whether the markets can continue higher or whether we are at or near a top of some kind. For some time I have been using intermarket analysis to help gauge market trend. In particular I have been tracking the relationship between the forex and equities markets and found that a "follow the money" approach is very useful.

It's interesting that the intermarket relationship between key currency pairs has gained favor very recently with much chatter now anticipating a "decoupling". Thusfar there is a tight relationship between a declining dollar and rising risk asset prices and vice versa. The EuroYen also trades in the same pattern. I do note that this relationship formerly displayed a significant lag of some weeks to even a month or more but has become virtually lockstep of late. This could indeed signal a decoupling may be in the offing.

A look at the EuroDollar reveals that this market is at a key juncture and an important move should materialize sometime in the next few weeks if not sooner. If the existing intermarket relationship holds then the future of the rally in equities will be written on this chart. If decoupling does ensue, there will still be valuable information to be gleaned from keeping a keen eye here. Let's have a look at a long term daily chart:

The predominant features of this chart are a double bottom in October and February, a huge cup and handle formation within a rising triangle formation and a bullish 50/200 EMA crossover with the 50 EMA providing recent support. RSI is positioned in somewhat neutral territory.

The triangle pattern is often a bottoming pattern but can also be a continuation pattern. The Cup and Handle pattern is among the most reliable and most powerful when it completes. As we can see there is some risk of a break of the uptrend off the February low should the Euro lose the 1.40 level. This would potentially negate the triangle bottom pattern but a further break below 137.50 would be required to call the cup and handle into question. Surely price could spend some additional time within the range of the handle and a false break of the uptrend could then reverse to the upside strongly for a breakout of the cup and handle neckline. It's just like a market to fake traders out of their positions and whipsaw in such a way! In many ways I regard this as the most likely outcome, given the extremely overbought condition of the equities markets and the unlikely prospects for an immediate decoupling. There is also an argument to be made for an immediate breakout. We have been consolidating for a week right at the neckline after breaking out of an intermediate term consolidation triangle. A break higher would lead to substantial and rapid upside as shorts cover and sideline longs jump on board. However, once again there is the overbought condition of the equities markets to consider.

Overall, one gets the sense that a pullback into the handle formation coincident with a retest of recent levels on the SPX on some profit taking is the most likely scenario. In either the bullish or bearish case, this chart provides us with some key technical levels which need to be watched.

Read my full analysis of the EuroDollar, "Follow the Money: EuroDollar at Critical Juncture"

The EuroYen has long been both an indicator of risk appetite and a major direct engine of liquidity to world markets via the Yen carry trade. The willingness of market participants to take on risk by selling the Yen and investing the proceeds in higher yielding assets is a leading indicator of recovery in asset prices. This cross is now challenging its 200 EMA and has been playing between the 50 and 200 for months. This chart is a great illustration of the transitional process that unfolds in a market as it moves from bear to bull. The market recently reversed a bear trap to jump over the 200 EMA soon followed by a bullish 50/200 EMA cross within 10 days and a breakout of a long cup and handle formation.

This chart shows a bullish trendline break, a test of the 200 EMA and a consolidation between the 50 and 200. Price is holding nicely above horizontal support at 1.30 and recent tests of the 50 EMA held. This is a reflation canary so keep your eyes on this market.

The Japanese Yen is now trading above both the 50 and 200 EMA with a bearish 50/200 crossover having aborted. We may also have a bull trap in place with a false breakout above the key 106 level. A retest of the 106-107 level is likely but if this fails a rapid decline below the 50 and 200 EMA will likely ensue leading to a bearish cross.

The US Dollar Index has crashed below the 50 and 200 EMA with a bearish crossover. The mini-bull market in the dollar was a direct result of the Financial Panic and a flight from risk assets to the relative safety of cash. If that worm has turned then cash will be disfavored over risk. The Dollar's breakdown out of a double top has been confirmed with price resting below the key 80 level which is VERY long term support. The recent technical bounce was very muted, failing to even give the 50 EMA a proper kiss goodbye. If US assets were suddenly deemed historically oversold the demand for dollar denominated assets could support the dollar. But that's a stretch. Treasury Secretary Geithner's recent whirlwind tour around the globe was likely to coordinate with key holders of US dollars on the imminent dollar devaluation. A minimum target would be the bottom of the accelerated (green) downtrend channel. If that channel fails then a full on crash scenario is at hand. A small bounce in the immediate term is likely. Note: if you flip this chart upside down you get a cup and handle formation. Price is sitting on the neckline now.

Long Term US Treasuries, which also played a flight to safety role during the Panic, has broken down decisively below its 200 EMA with a bearish 50/200 crossover. This may be very bullish action for equities since the money parked in Treasuries will look for a new home in risk assets. The breakdown is all the more dramatic given the Fed's new "Quantitative Easing" policy of direct monetization of US debt. Having said that, if there is a panic out of the dollar a panic out of all dollar denominated assets, including equities, could ensue. A major bond auction takes place this week. I'm expecting that Geithner has somehow arranged for the auction to not flop horribly and that the news that the auction was "bid strongly" will bolster the dollar and the bond market--for about 2 days.

At this point, all of the panic driven "flight to quality" gains have been given back. Trend support has been violated and the break has been backtested. The bearish 50/200 crossover signals a long term bear market in US debt.

Gold is the classic inflation canary and its persistent resistance to the deleveraging trend may be good indicator of future asset price reflation. Technically, Gold had many opportunities to break down and head for its long term trendline in the 650-700 area yet it failed to do so. Once price crossed the 200 EMA and the subsequent bullish 50/200 crossover it held several times on tests of the 200 EMA and has recently broken back above the 50 EMA on a weekly basis. The predominate feature of this chart is 50/200 bullish crossover with both turning up. One of the strongest technical indicators is a failed pattern or reversed false break. We have two such occurrences in this chart. The potential double top may be failing and the intermediate term H&S top has failed this week. A long term reverse H&S may be forming its right shoulder now. A retest of the 92 level is likely on a dollar bounce soon. That would provide an excellent entry point. If the reverse H&S pattern fulfills itself then we are looking at a move to $1300 in the next move based on a distance of $300 from the neckline to the bottom and the inverse move from neckline to top.

Silver has signaled a renewed bull market and a bullish 50/200 crossover has occurred. A similar configuration occurred just before the last huge run up. We recently saw a retest of the cup and handle breakout and a breakout above the intermediate term downtrend back above all EMA's. There is also a bear trap in place on the failure of the break of the long term uptrend. A retest of the 50 EMA is likely providing a good entry point for what should be an explosive move above the 16.00 level. A failure at 12.50 calls the entire move in silver into question.. A pullback in the next few days on USD technical strength could provide a good entry point. I would buy the dips here if this market interests you. I am favoring silver over gold as it is both an inflation hedge and an industrial metal.

The Gold Miners ETF (GDX) has broken out under very bullish circumstances. Like gold, the gold equities have shown failed bearish patterns: longer term and shorter term bearish rising wedges as well as a triple top at 38.00. A retest of the recent breakout above 38.00 will provide an excellent entry point. This chart is a strong buy.

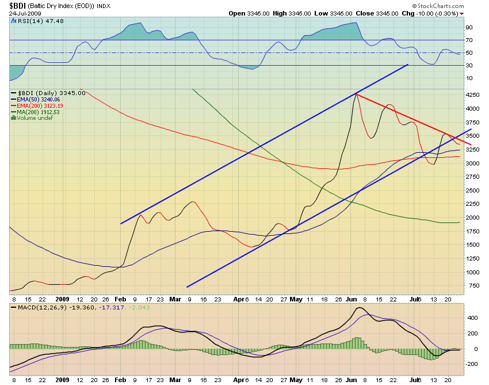

The Baltic Dry Index has been a much touted index of global economic activity and was certainly showcased as a herald of worldwide economic collapse. It's interesting that bears are silent on this index now that is in a definite uptrend. The recovery in the BDI gives the lie to the global depression hypothesis. The chart shows price rising and a bullish 50/200 EMA golden cross EMA. After consolidating in a pennant formation the index appears ready to resume its uptrend.

Copper is also considered a leading indicator of global economic activity. A bullish 50/200 EMA crossover was the matchstick to ignite a recent rise to new highs. This is a very bullish development and strongly contradicts the recession/depression thesis. It is also a harbinger of inflation. At this time China is taking much of its recently appreciated dollar reserves and buying up recently depreciated hard assets like copper. It is tough to argue for a deflationary or global depression scenario in the face of a bull market in copper. Also of note is a bullish cup and handle formation (uncharted), one of the most reliable formations in technical analysis.

CRUDE OIL has retested its support trendline and retaken its 50 and 200 EMAs with a bullish golden cross imminent. The fundamental implications of this are the same as for copper.

The Volatility Index (VIX) trends inversely to the equities markets and is in a clear downtrend. A bearish 50/200 crossover occurred which may be signaling a bull market in equities. Could this be a false signal? Sure! But it's not likely given the extensive process required to produce this technical condition.

The bearish 50/200 crossover is predominate feature of this chart. VIX continues its clear downtrend having tested the key 30 level, the 50 EMA and its downtrend line from below all on the same day. The firm rejection of this test coincided with the massive rally in equities. Caution: tests of this downtrend line have also coincided with bounces in the equties market. Any plunge below it may indicate that a new "melt up" phase has begun in equities.

EQUITIES MARKETS

The S&P 500 index of large capitalization stocks is my preferred indicator for overall market trend and performance. We can see that price has broken out above the January and June highs in the 950 area and above its 200 EMA. Although I would suspect a short term pullback to the area of the 200 EMA is likely before the market advances further, the setup is for a transitional period from bear to bull with an eventual 50/200 crossover. There was a break of the uptrend from the March lows but a downtrend never took hold, resolving the break of support with a bear trap instead.

Note relatively low volume on the pullback which gives the chart the overall bullish bias of a flat consolidation within an uptrend rather than a topping pattern.

On a very long term basis, the SPX is showing the potential for making a secular bear market bottom. One of the most consistently and powerfully bullish technical occurrences is the false break or Bear Trap. A false break of a secular market trendline is particularly powerful. The SPX may in fact have had such a failed technical event at the March break below the market's long term secular bull market support zone. Coming as it did amidst fears of a global economic and financial meltdown this event also takes on characteristics of a panic capitulation bottom. Note the massive volume in the zone of the event (which remains historically elevated as well, I might add). In any case, this hypothesis will be either validated or nullified soon with a bullish 50/200 crossover or a rally failure. It won't be long and patience will pay off.

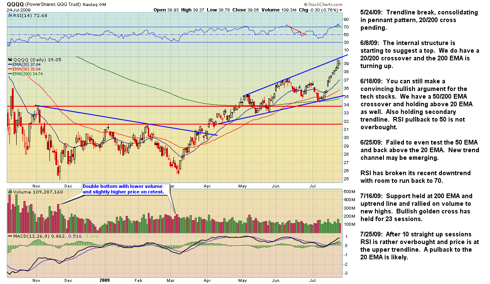

The Nasdaq 100 (QQQQ) led the move off the March bottom and has maintained a consistent uptrend. We have a clear golden cross which has been maintained for more than 6 weeks. With RSI overbought on the daily chart and price at trendline resistance a bit of a pullback is likely here.

Semiconductors (SMH) also led the bull move and recently surged. A 50 and 200 EMA crossover has occurred. I regard the semiconductors as commodities. Chips are a basic economic input like copper or crude oil. The fact that they bottomed well ahead of the rest of the market and are vastly outperforming speaks volumes about the future of the economy and the markets and may portend the aforementioned technological revolution.

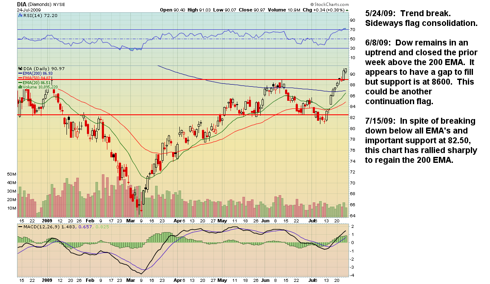

The Dow Industrials (DIA) has lagged other indices but is nonetheless rallying strongly.

The Russell 2000 Small Cap Index (IWM) challenged its 200 EMA twice and pulled back on low volume. It is now nearing a bullish 50/200 EMA crossover.

The Financial Sector (XLF) has been consolidating in a narrow range between 11 and 13 since May. This chart displays a reverse head and shoulders pattern that can also be seen as a cup and handle formation. A break above the 12.85 neckline and 200 EMA resistance is likely produce a rally that will carry to 19-20 zone.

THE CHART OF THE CENTURY

The US dollar has been the world's reserve currency since World War II. It is now literally the butt of jokes and discussion of its eventual replacement in commonplace and in the open. When such chatter reaches the airwaves and the newspapers the decision has already been long ago taken by the inner clique. The dollar will decline to reflect its basic supply-demand reality. It will no longer be in demand and the Fed is creating them as if they were wanting. Short the US dollar holds the potential to be a very profitable trade. Be ready. It may be only days from a major break.

THE "WRONG POINT"

This analysis is written with a bullish bias based on an inflationary/reflationary fundamental premise. However, the same technical indicator which would validate this hypothesis would also negate it. Just as a bullish 50/200 crossover would confirm a bull market, a bearish weekly close below the 50 EMA on the SPX would call the nascent bull into question. I call this the "Wrong Point". It's the technical and psychological moment at which I know that my market position is wrong.

A weekly close above the 80 level on the US dollar index would also cause me to reassess my stance.

CONCLUSION

Having largely completed its initial impulsive short covering rally off an historically oversold bottom produced by a generational Financial Panic, the nascent Bull Market then consolidated during a transitional period technically characterized by the interplay between price and the 50 and 200 EMA's. Investors used this period to buy the dips to accumulate positions. Bears attempted to reposition for an anticipated decline by selling rallies but have been caught in a Bear Trap when the break of the 880 level proved to be false. A breakout to new highs has coincided with a very bearish setup in the US dollar. If the weak dollar/strong risk asset price intermarket relationship holds, there should be some very dramatic moves in the next couple of weeks. The potential for this to be a false setup is diminished by the recent failure of the bearish setup for equities and the very long term bearish technical setup and overwhelmingly negative fundamentals for the US dollar. There are no slam dunks in trading but thus is a strong configuration of forces.

DISCLOSURE: The author is currently 10% short the Nasdaq 100 and the IWM as a very short term play with an eye towards a short position in the US dollar and long technology, financials and emerging markets sometime in the near term.

Comment

-

Comment by Steven Vincent on July 26, 2009 at 10:19pm

-

The latest BBMR has been posted as a featured article on MarketOracle.UK!

http://www.marketoracle.co.uk/Article12305.html

© 2024 Created by Steven Vincent.

Powered by

![]()

You need to be a member of BullBear Trading: Stock and Financial Market Technical Analysis to add comments!

Join BullBear Trading: Stock and Financial Market Technical Analysis